Russia is the eleventh-largest economy in the world by nominal GDP and the fourth-largest by purchasing power parity. This makes Moscow a key player globally. The country runs a high-income, industrialized, mixed-market model, joining the World Trade Organization in 2012.

The Russian economic classification is complex. It has moved from Soviet central planning to a hybrid system. This system mixes market mechanisms with significant state intervention. This is clear in sectors like national security and energy, where Moscow controls vast resources.

After the 2022 invasion of Ukraine, Western nations put tough sanctions on Russia. Yet, Russia’s economy today shows strength. It has high military spending, rising household spending, low unemployment, and more government spending. This shows the complex mix of market and state influence in its economy.

What Economic System is Russia Operating Today?

Russia’s economy is hard to pin down using Western economic models. It blends market forces with strong government control and state ownership. This mix makes its economy unique, unlike pure capitalism or socialism.

Global financial bodies see Russia as a high-income, industrialized economy with market traits. Yet, its Russian market system overview shows big differences from Western economies. The government plays a big role in key sectors, but private markets work in consumer goods and services.

The Mixed Market Economy Classification

Russia is officially a mixed market economy Russia. Private companies and state-run corporations work together. Most consumer goods, housing, and services are priced by market forces. Private businesses compete freely in many sectors.

About 70% of Russia’s total GDP comes from domestic spending. This shows the strong role of private spending in the economy. Small and medium-sized businesses also play a big part in employment and production.

Entrepreneurs have grown in number and influence. They start businesses, make deals, and respond to market needs. Property rights are common, but enforcement can vary.

Despite its market aspects, Russia is seen as “Mostly Unfree” in economic freedom. This is due to unpredictable regulations, selective law enforcement, and government interference beyond Western norms.

State Capitalism as Russia’s Defining Feature

The best way to describe Russia economic system analysis is through state capitalism. The government owns and controls key sectors like energy and banking. But, it lets markets compete in other areas.

State-owned companies dominate in strategic sectors. Gazprom leads in natural gas, Rosneft in oil, and Sberbank in finance. These companies make decisions based on politics and national goals, not just profit.

The oil and gas sector was a big source of federal budget revenue, about 30% in 2025. This shows the government’s control over energy. State ownership ensures that resource revenues go to the government, giving it power through energy exports.

| Economic Characteristic | Russia’s Current System | Impact |

|---|---|---|

| Ownership Structure | Mixed private and state | Defines hybrid model |

| Strategic Sectors | Government control (energy, banking, defense) | Establishes state capitalism |

| Domestic Consumption | 70% of GDP | Indicates strong private market |

| Economic Freedom | “Mostly Unfree” | Reflects state interference |

| Resource Revenue | 30% of budget | Reinforces state control |

Russia’s Economic Evolution: From Soviet Socialism to Market-Based System

Russia’s economy today has three key periods. These periods changed Russia’s financial scene a lot. The Soviet economic transformation started in 1922 and lasted for 70 years. It was followed by market reforms in the 1990s and then stability in the 2000s.

Soviet Central Planning (1922-1991)

The Soviet Union had a command economy. The state owned everything and planned the economy through five-year plans. These plans set goals, controlled prices, and decided who got what.

This system helped Russia grow fast. By the 1950s, it became a big industrial power. But by the 1970s, it was struggling to keep up with modern needs.

The 1970s to 1985 were tough. Corruption and fake data hid the economy’s problems. This led to the Soviet Union’s fall.

Radical Privatization During the 1990s

After the Soviet Union fell, Russia started big changes under President Boris Yeltsin. The “shock therapy” approach was fast and radical. It made prices free and markets open quickly.

This change was very hard for people. The economy dropped by over 40% by 1999. Savings were lost due to high inflation.

Assets were sold cheaply to a few rich people. This was called “Prikhvatizatisiya”. Many became poor, and life expectancy fell.

Economic Stabilization and Growth After 2000

Vladimir Putin became president in 2000 and started Russia’s recovery. The economy grew fast, thanks to high oil and gas prices. Between 2000 and 2008, it grew by 7% every year.

By 2012, people’s income had risen by 160%. Poverty fell from 30% to 14%. Putin’s government made big changes to help the economy.

A new tax system was introduced. It had a flat 13% income tax. This brought in more money. The government also paid off debts early. But, some key areas were kept under state control.

Core Characteristics of Russia’s Economic Structure

Russia’s economy is built on four key pillars. These pillars shape the country’s business world and its financial health. They show how private businesses and state control work together in important areas. This mix makes Russia’s economy different from others.

Russia’s economy is big, with a $2 trillion GDP and 73 million workers. It’s the eighth-largest job market and twelfth-largest consumer market globally. About 70% of the economy comes from what people buy and use inside the country.

Private Sector Development and Market Competition

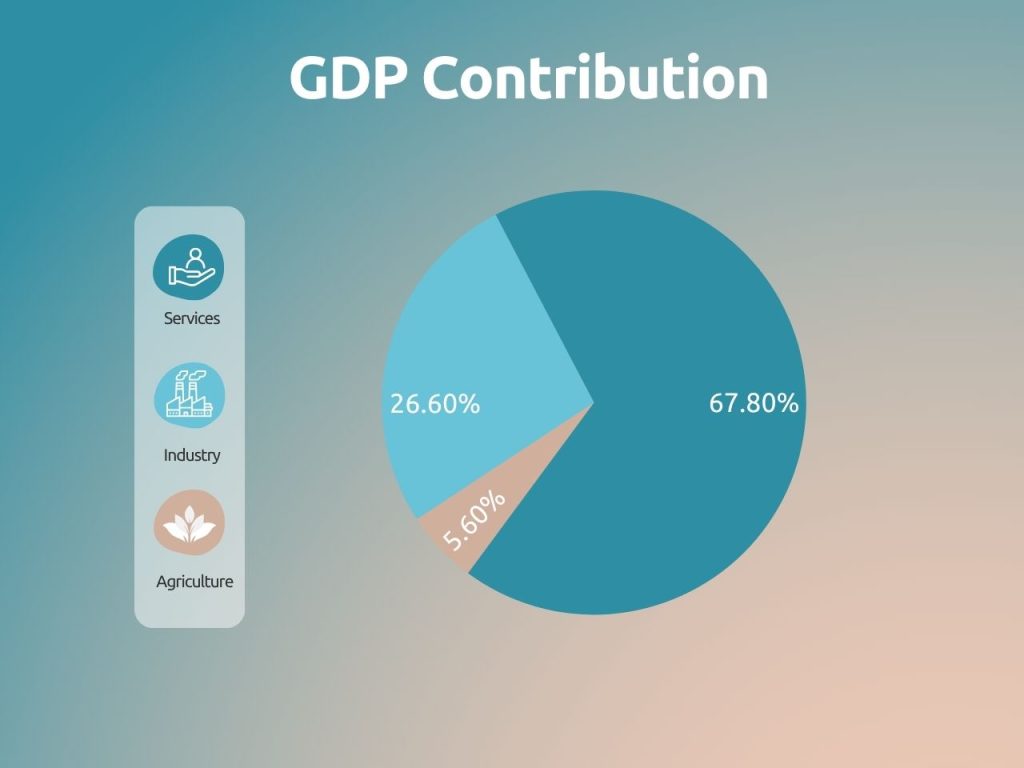

The service sector is the biggest part of Russia’s economy, making up 67.8% of GDP in 2022. Private companies are big in retail, hospitality, tech, and more. Small and medium businesses also do well, thanks to lower taxes in some areas.

Where the government doesn’t interfere too much, private companies compete for customers. They fight for people’s money in areas like phone services, food, and online services. This competition helps businesses grow, mainly in big cities like Moscow and Saint Petersburg.

Strategic State-Owned Enterprises and National Champions

The government owns or controls big companies in energy, banking, defense, and transport. Key state-owned firms include Gazprom and Rosneft in energy, and Sberbank and VTB in banking. Russian Railways and United Aircraft Corporation are also state-run. These companies get special treatment and lead their fields.

These national champions face less competition and get government help. This support gives them financial stability and rules that help them. It keeps key sectors safe from market changes and helps the government control the economy and politics.

Natural Resource Dependence and Export-Driven Growth

Russia has huge reserves of natural gas, coal, and oil. It’s the top exporter of natural gas and second-largest oil exporter. In 2024-2025, oil and gas made up 30% of the federal budget, down from 50% in the mid-2010s.

Changes in oil prices affect Russia’s budget and economy a lot. When oil prices drop, the budget gets into trouble and the currency weakens. This makes the economy go up and down, even with efforts to diversify.

Informal Economy and Shadow Market Activity

A lot of economic activity happens outside of official rules. Corruption, red tape, and complex laws push businesses into the shadows. Russia ranks 141st out of 180 countries in corruption, with a score of 26 out of 100.

Shadow markets make it hard to know the true size of the economy and hurt tax collection. About 20-40% of economic activity is unofficial in some areas. This hidden economy hinders formal business growth and scares off foreign investors, making governance tough.

| Sector | GDP Share | State Role | Notes |

|---|---|---|---|

| Services | 67.8% | Low–Moderate | Private enterprise dominance |

| Industry | 26.6% | High | Defense & heavy industry |

| Agriculture | 5.6% | Low | Private farms, food security |

| Energy | — | Very High | State-run, export-driven |

State Control Mechanisms in Russia’s Economy

Moscow’s economy is managed through three main tools: owning key assets, setting rules, and mixing politics with business. These methods help the government control important sectors while seeming to support market competition. The government shapes the economy through both clear ownership and less obvious rules.

This approach lets the Kremlin influence businesses without fully taking them over. Companies in Russia face a complex world where official rules are less important than who you know.

Direct Control Through Energy and Defense Assets

State-owned companies in the energy sector show the government’s economic role. Gazprom holds about 15% of the world’s natural gas reserves and acts like an arm of the Kremlin’s foreign policy. Rosneft leads in oil production, with the government watching closely.

The defense sector is also under state control. Rosatom handles all nuclear energy and exports, and defense companies are mostly owned by the government. These areas bring in a lot of money for the government and help achieve national goals.

Energy is a big part of Russia’s exports. The government uses this to keep the budget stable and influence other countries through gas and oil deals.

Regulatory Authority and Discretionary Enforcement

Regulatory power is another flexible tool for control. Licensing, tax checks, and safety inspections can be used to favor or punish businesses. Companies that support the government often get easier approval.

Those who disagree with the Kremlin face more scrutiny. Unexpected problems, legal issues, or permits being pulled can influence businesses. This unpredictability scares off foreign investors and weakens property rights.

Russia’s poor property rights scores show this. The risk of losing property and uneven intellectual property rules make informal connections more important than the law.

The Political Loyalty Factor in Business Success

Being close to the government is key to success in important sectors. Oligarchs and big business leaders stay in power by showing loyalty to the administration. Those who oppose the government risk losing their assets, facing charges, or being forced to leave.

This system means big business decisions need informal approval, not just following the rules. Business leaders think about political connections before making moves or entering new markets. This shows how the government’s influence spreads through the economy.

Corruption limits economic freedom by adding pressure to business deals. State-owned banks and financial institutions limit access to credit and competition, strengthening these networks.

| Mechanism | Key Sectors | Tools | Economic Effect |

| State Ownership | Energy, Banking, Defense | Gazprom, Rosneft | 60% GDP under state influence |

| Regulation | All | Audits, Licensing | Limits competition |

| Political Patronage | Strategic Industries | Loyalty networks | Concentrates wealth |

| Financial Control | Banking | State bank dominance | Restricts credit access |

Russia’s Economic Policies and Reform Trajectory

Moscow is focusing more on being economically self-sufficient due to rising global tensions. The government has taken steps to protect the economy from outside shocks. These steps aim to keep the economy stable while also making it less dependent on others.

Domestic Production and Protectionist Measures

Russia has been working hard to make more things at home, starting in 2014. This effort got stronger in 2022. The government helps by giving subsidies, setting tariffs, and choosing Russian products for government purchases.

This plan has helped a lot in agriculture. Russia went from being a big wheat buyer to the world’s top wheat seller. It’s also working in aerospace, pharmaceuticals, and tech.

But, there are challenges. Russian products might not be as good as foreign ones. Also, Russia depends on other countries for some key technologies.

Using protectionist policies can make things less efficient. It can also make domestic producers less motivated to improve. Finding the right balance between being self-sufficient and competitive is hard for Russia’s leaders.

Financial Resilience Under Pressure

The sanctions on Russia have had a big impact, but not as bad as some thought. After the 2022 Ukraine invasion, the West put tough restrictions on Russia’s finances, energy, tech, and rich people. They wanted to cut Russia off from Western markets.

Russia has found ways to stay strong, like controlling money and reaching out to Asia, like China and India. It also set up new ways to pay for things and kept selling energy. Despite all the sanctions, Russia’s economy grew by 4.1% in 2023-2024.

2025 growth is expected to slow sharply — government projects ~1.5 %, World Bank ~1.4 %, while the IMF’s latest forecast is 0.6 %. Inflation went up to 9% in 2025. Experts say this could hurt Russia’s economy in the long run because of less technology and money leaving the country.

Reducing Hydrocarbon Dependence

Russia is trying to move away from just relying on oil and gas. In the mid-2010s, oil and gas made up 50% of the federal budget. By 2024, it was down to 30%, projected to go down to ~25% in 2025. This shows progress in diversifying the economy.

The government wants to grow other sectors like agriculture, defense, aviation, tech, and digital services. Tax changes in 2000-2002 helped small businesses grow. These changes are helping to change the economy’s makeup.

But, it’s hard to move away from oil and gas. Other sectors can’t compete with the advantages of natural resources. Not enough money is spent on research and development, and many skilled workers leave the country. These problems make it hard to change the economy, even with good plans.

| Policy Area | Key Initiatives | Period | Results |

| Import Substitution | Subsidies, tariffs | 2014–present | Wheat self-sufficiency; tech lag |

| Sanctions Adaptation | Alt. payment systems, Asia trade | 2022–present | 4.1% GDP growth; inflation 7.9% |

| Diversification | R&D, tax reform | 2000–present | Oil/gas share ↓ from 50%→30% |

| Fiscal Reform | Flat 13% tax | 2000–2002 | Boosted SME growth |

Evaluating Russia’s Economic Model Against Global Systems

To understand Russia’s role in the global economy, we compare its state capitalism with other major systems. This shows how Russia’s hybrid structure is different from Western markets and Eastern command economies. This difference is important for businesses, policymakers, and observers to understand Russia’s economic path and its place in the world.

Looking at Russia’s economic model through a comparative lens gives us insight into its performance and challenges. Russia is classified as “Mostly Unfree” for economic freedom. This affects its trade relationships and foreign investment.

How Russia Differs From American Free Market Capitalism

The comparison between Russia and the US shows big differences. The US has little state ownership, focusing on regulation. Private property rights are well-protected by independent courts that enforce contracts without political bias.

Russia, on the other hand, has strategic state control in key sectors like energy and banking. Political influence plays a big role in business decisions, unlike in the US. The US is seen as “Mostly Free” for economic freedom, with competitive markets and rules against monopolies.

Wealth distribution is very different between the two. Russia has many billionaires but high income inequality. In contrast, the US has more dispersed wealth, despite debates on inequality.

Russia’s Model Versus European Social Market Economies

European countries like Germany and France balance market efficiency with social welfare. They have competitive markets and strong rule of law, attracting investment while protecting workers. They fund public services through progressive taxation.

Russia keeps some social programs from the Soviet era, but in a weaker framework. European economies score higher in economic freedom and human development, despite larger government sectors.

Regulatory consistency and transparency also differ. European economies enforce rules predictably, while Russia’s selective enforcement creates uncertainty. This impacts foreign investment and entrepreneurship in both regions.

Parallels and Contrasts With Chinese State Capitalism

The comparison between Russia and China shows both similarities and differences. Both have significant state ownership and government influence over business. State-owned enterprises are policy tools in both countries, with markets operating within political boundaries.

China’s model has been more successful in some ways. China has seen consistent growth, built a large manufacturing base, and integrated into global supply chains. Its economic policy has attracted more foreign investment than Russia. China has lifted hundreds of millions out of poverty, while Russia experienced economic decline in the 1990s.

Russia’s focus on resource exports contrasts with China’s diversified economy. Sanctions after the 2022 invasion of Ukraine have further isolated Russia. China has avoided these sanctions and faces different economic challenges.

Conclusion

Russia’s economy is a mix of market and state control. It’s a mixed market economy with strong state capitalist traits. This model came from years of change after Soviet central planning.

Russia’s economy is the eleventh-largest by nominal GDP and fourth-largest by purchasing power parity. After the 2022 Ukraine invasion, its economy showed surprising strength. It saw military spending, rising wages, and low unemployment. But, inflation remains high, and sanctions will likely cost more in the long run.

Russia’s economic future is challenging. Corruption is a big issue, ranking the country 141st in transparency. The population is aging and shrinking, threatening the workforce. Skilled workers are leaving, and technology gaps are growing due to sanctions and lack of investment.

Russia’s economy will likely stay a hybrid model. The state controls key sectors, while private businesses operate elsewhere. Success depends on fixing institutional weaknesses, addressing demographic issues, and closing technology gaps. Russia’s economy reflects its unique history and politics, making it hard to categorize but full of challenges and opportunities.

FAQs

What Economic System is Russia Currently Using?

Russia has a mixed market economy with a big role for the state. It’s called state capitalism. The economy mixes market rules for most goods and services with state control in key areas like energy and banking. About 70% of Russia’s GDP comes from private sector and domestic spending.

State-owned enterprises dominate strategic sectors. This model balances market competition in non-critical areas with state control in vital ones. It’s hard to categorize as purely capitalist or state-controlled.

How Did Russia Transition From Soviet Central Planning to its Current System?

Russia’s economic shift happened in three phases. From 1922 to 1991, it had a centrally planned economy under the Soviet Union. After the Soviet collapse, Russia adopted “shock therapy” reforms in 1992.

This included fast privatization and market opening. But it led to a huge GDP drop, high inflation, and poverty. The current system started in 2000 under President Putin, with a focus on strategic sectors and private enterprise.

What Role Do State-Owned Enterprises Play in Russia’s Economy?

State-owned enterprises are key to the Russian government’s control over strategic sectors. Big companies like Gazprom and Rosneft operate under government ownership or control. These “national champions” dominate their industries and often get special treatment.

The government uses these companies for policy goals and to serve strategic interests. Energy sector state-owned enterprises alone bring in about 30% of federal budget revenues. This shows their importance beyond their market dominance.

What is Import Substitution and How is Russia Implementing it?

Import substitution is Russia’s policy to replace foreign goods with domestic production. The government supports this through subsidies and tariffs. It aims to boost manufacturing, agriculture, and technology sectors.

Successes include becoming the world’s largest wheat exporter. The strategy also targets aerospace and pharmaceuticals. Yet, quality gaps and technological dependence remain challenges.

How Does Russia’s Economic System Differ From American Free Market Capitalism?

Russia’s state capitalism differs from the U.S. free market system. The U.S. has minimal state ownership and strong private property rights. Russia, on the other hand, controls key sectors and has weaker property rights.

Economic freedom scores show Russia as “Mostly Unfree.” The country has higher income inequality and wealth concentration among oligarchs. This contrasts with the more dispersed wealth in the U.S.

Russia and China share state capitalism traits like state ownership and influence. But, China has grown faster, attracted more foreign investment, and integrated more into global markets. China’s pragmatic approach lifted millions from poverty.

Russia’s economy is more focused on resource extraction. Both systems struggle to balance state control with market efficiency for sustained growth.

Does Russia Have a Free Market Economy?

Russia does not have a free market economy. While private sector activity generates 70% of GDP, the state controls strategic sectors. International institutions classify Russia as “Mostly Unfree” economically.

Weak property rights, selective regulation, and corruption distinguish Russia’s system. It’s a hybrid where market mechanisms operate within state boundaries.

What Are Russia’s Main Economic Strengths in 2025?

Russia’s strengths include its large economy, vast natural resources, and educated workforce. It’s the world’s eleventh-largest economy by nominal GDP and has the largest natural gas reserves.

Recent resilience to sanctions shows adaptability. Despite challenges, Russia’s economic leverage allows it to pursue strategic goals.

How Much of Russia’s Economy is Controlled by the Government?

The Russian government controls a significant part of the economy, mainly in strategic sectors. State-owned enterprises dominate energy, banking, and defense. The government owns or controls these “national champions.”

This control extends beyond formal ownership through informal influence and oligarchs. The system blends state control with private sector activity.