From caution to coordination, Russia–China ties have deepened since 1991. After the Sino-Soviet split and the 1969 clashes, Moscow and Beijing normalized relations in the 1990s. Today’s partnership rests on energy, trade/finance, and diplomatic coordination—leaders call it “not allies, but better than allies,” while Putin has described it as a de facto alliance (reiterated during Xi’s 7–10 May 2025 visit to Moscow and Victory Day events).

Russia’s 2022 invasion of Ukraine have further strengthened this bond. Europe’s reduction in Russian coal and oil imports has redirected these flows to Asia, with China being a major beneficiary. By 2023, trade between the two nations had reached nearly $240 billion, highlighting their strategic cooperation in markets, logistics, and technology.

Energy remains the cornerstone of Moscow-Beijing relations. Pipeline crude and redirected seaborne shipments, along with state-owned enterprises, influence OPEC+ policies. This shapes global prices from Shanghai to Rotterdam. The outcome is a complex network of deals, risk-sharing, and payment routes, solidifying their serious, albeit treaty-free, alignment.

This partnership significantly impacts Washington and its allies, altering supply chains and complicating economy. The Russia-China alliance now plays a long-term role in security and energy planning. It anchors a broader discussion on power, markets, and the rules governing them.

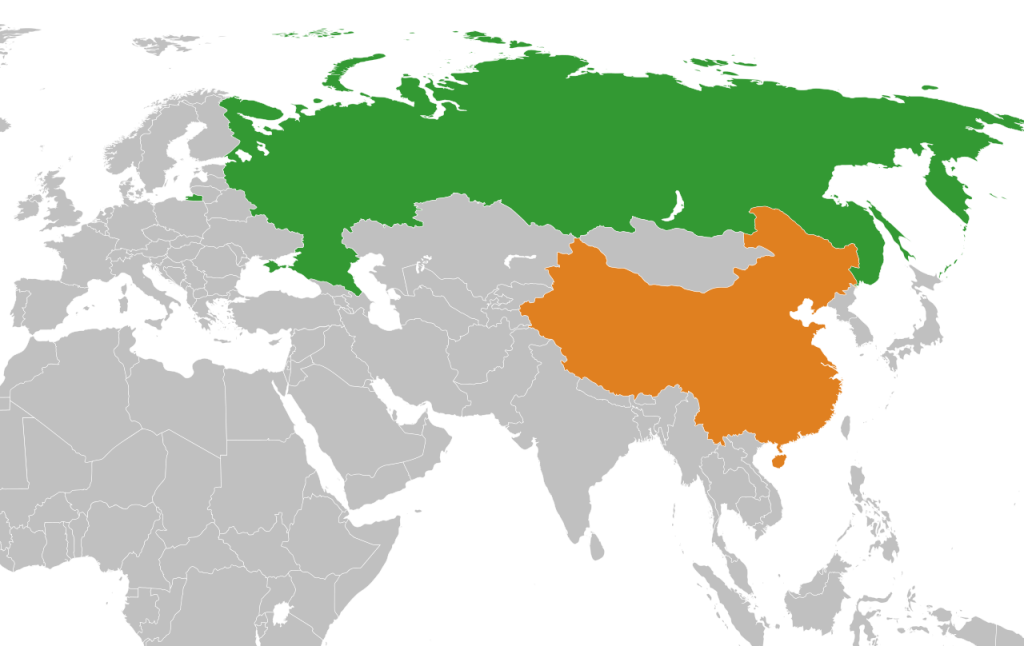

Map: NordNordWest, via Wikimedia Commons under CC BY-SA 3.0.

Origins and Evolution of the Sino-Russian Partnership

The sino-russian partnership evolved as the Cold War concluded. In December 1992, Boris Yeltsin met Jiang Zemin and Yang Shangkun in Beijing. This meeting reset Moscow–Beijing relations, opening a channel for steady dialogue.

By 1996, a joint communique outlined an “equal and reliable partnership.” This marked a shift toward a more balanced world order. It framed cooperation as practical, not ideological. This period aligned with shared interests in stability and regional security.

From Post–Soviet Normalization to Strategic Coordination (1991–Present)

Post-Soviet normalization laid the groundwork for broader policy coordination. Russia supplied defense hardware as China modernized the PLA. Regular summits followed, deepening ties. The Eastern Siberia–Pacific Ocean pipeline added energy depth and linked Siberian fields with long-term buyers in Asia.

The Shanghai Cooperation Organisation, launched in 2001, managed borders and terrorism risks. During the 2008 war in Georgia, Beijing stressed sovereignty. It kept the SCO neutral, showing coordination and distance could coexist.

Treaty of Good-Neighborliness and Friendly Cooperation (2001, Renewed 2021)

The Treaty of Good-Neighborliness formalized cooperation in security, trade, and culture. Analysts noted implicit security elements, despite no defense pact. In June 2021, the treaty was renewed for five years, reflecting strong Moscow–Beijing relations amid rising friction with Washington.

After 2014 sanctions over Crimea, Russia expanded outreach to Chinese markets and finance. While some firms considered secondary sanctions, overall exchanges grew. This reinforced the Sino-Russian partnership in energy, technology, and logistics.

Border Demarcation and Normalization of Moscow–Beijing Relations

Border demarcation began in 1991 and concluded in the 2000s. It ended centuries of disputes. The final agreements removed a chronic source of distrust, enabling routine cross-border trade and regional development.

With the frontier settled, Moscow–Beijing relations focused on practical cooperation. Stable borders supported joint projects. They made the Treaty of Good-Neighborliness easier to implement, anchoring post-Soviet normalization in binding, verifiable terms.

Geopolitical Drivers: Challenging a Unipolar Order

Beijing and Moscow see their cooperation as a pushback against a U.S.-dominated system. They emphasize sovereignty and noninterference, aligning with a multipolar world vision. This shared perspective underpins a pragmatic alliance, aiming for more national autonomy.

Russia’s concerns center on NATO’s expansion and sanctions over Crimea and Ukraine. China faces challenges in the South China Sea, chip restrictions, and trade disputes. These issues fuel the Russia China alliance, as both sides test their influence in the U.S.–China–Russia rivalry.

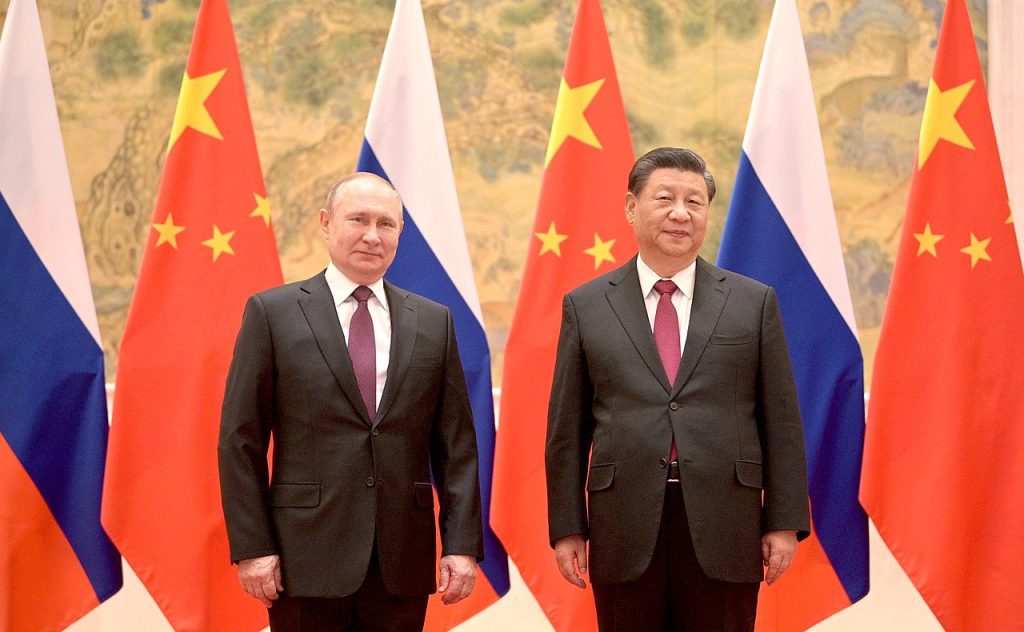

The alliance’s coordination intensified with Russia’s military buildup and a key meeting between Putin and Xi Jinping in Beijing. As sanctions mounted, Russia redirected its energy and trade to Asia. China’s demand and logistics helped absorb these changes, without a formal defense pact.

Both governments downplay ideology but show a firm stance against dissent. They closely observe each other’s methods for media control, data oversight, and managing protests. This reinforces their geopolitical alignment.

Beijing benefits from cheaper oil and gas, while maintaining flexibility in military commitments. Moscow gains new markets, diplomatic support, and access to finance and technology outside the dollar system. Both present their actions as steps toward a multipolar world, aiming to reduce U.S. dominance.

The russia china alliance is flexible, not bound by treaties. It thrives on shared interests and strategic risk-taking, keeping options open amidst the U.S.–China–Russia competition’s pace of change.

| Driver | Russia’s priority | China’s priority | Effect on U.S.–China–Russia competition |

|---|---|---|---|

| Security pressure | Oppose NATO enlargement; seek recognition of red lines in Eastern Europe | Manage Taiwan/South China Sea risks without open war | Dual-theater strain for Washington/allies |

| Sanctions & tech | Offset sanctions via Asian markets & non-dollar channels | Work around export controls on chips & dual-use tech | Parallel supply chains & payments |

| Energy & trade | Redirect crude/diesel/coal east at discounts | Lock in long-term supply on favorable terms | Pricing power & routes shift toward Asia |

| Information control | Tighten media & platform rules | Deepen data governance | State-centric governance model spreads |

| Diplomatic signaling | Use UN veto; regional forums | Shape narratives across the Global South | Builds coalitions for a multipolar order |

Economic Interdependence and Russia China Trade Agreements

Trade has dramatically shifted eastward, with Russia and China’s trade agreements deepening amidst sanctions. This shift spans various sectors, including energy, metals, machinery, and payments. Logistics and finance sectors are adapting to these new dynamics.

Energy is at the core of this realignment. Crude, diesel, and coal are now flowing more to Asia. Banks and insurers outside the West are supporting these shipments. The pricing reflects OPEC+ dynamics and discounting, influencing inflation and freight costs.

Record Bilateral Trade Surpassing $240 Billion in 2023

In 2023, bilateral trade between Russia and China reached about $240 billion. This was after Russia redirected commodities to China due to Western sanctions. Exporters began using yuan and ruble settlements, with non-Western clearing becoming more prevalent.

Goods like consumer items, autos, and machinery moved in the opposite direction. This diversification highlights the pragmatic nature of Russia-China trade agreements. They prioritize stable supply and predictable prices.

Energy Flows: ESPO Pipeline, Coal Redirection to China, and Asian Markets

The ESPO pipeline supplies crude to Chinese refineries in Heilongjiang and Liaoning. Tankers from Kozmino complement these pipeline volumes, meeting Asia’s growing demand for over 100 million barrels per day.

Russian coal, due to Europe’s transition and Ukraine sanctions, now goes mainly to China and other Asian markets. The Far East’s port capacity and rail links have become critical for investment.

Map: MShirkov, via Wikimedia Commons under CC BY-SA 4.0.

State-Owned Enterprises, OPEC+ Dynamics, and Oil Price Impacts

State-owned enterprises dominate global reserves and output, influencing timelines and budgets. Companies like Saudi Aramco and Rosneft set the pace for volumes and refinery terms.

OPEC+ dynamics, including Russia’s cuts, have pushed prices over $80 per barrel. The blend of disciplined supply and discounted barrels to Asia has affected inflation and refined product margins.

Technology, Logistics, and Sanctions Workarounds

Despite G7 price caps and finance limits, Russia maintains exports with alternative insurance and shadow fleets. New routes, reflags, and cargo transfers support these flows. Customs scrutiny tracks serial shipments.

Chinese firms have sometimes reduced exposure to secondary penalties. Yet, trade in dual-use items, chips, and machine tools remains under review. Payments systems outside the dollar and localized logistics reinforce economic ties.

| Domain | Modality | Recent examples | Market effect |

|---|---|---|---|

| Record trade | Yuan–ruble settlements; customs facilitation | 2023 $240.1B; 2024 $244.8B | Higher volumes; diversified goods mix |

| Crude flows (ESPO/Kozmino) | Pipeline + seaborne ESPO to China | Steady Kozmino loadings | Regional price signals; stable feedstock |

| Coal redirection | Rail/port upgrades in Far East | Higher deliveries to Chinese utilities | Greater Asian supply; lower Atlantic relevance |

| SOEs & OPEC+ | Long-term contracts; managed cuts | Rosneft/CNPC; OPEC+ curbs | Price support at times; inflation pressure |

| Sanctions workarounds | Alt insurance; re-flags; STS transfers | Shadow fleets; parallel logistics | Sustained exports at discounts |

| Tech/logistics | Dual-use trade under scrutiny | Machine tools, chips; compliance frictions | Operational continuity with risk |

Russia China Alliance

The russia china alliance, though lacking a formal defense pact, significantly influences markets and diplomacy across Eurasia and the Pacific. Moscow and Beijing describe their relationship as pragmatic and driven by mutual interests. Trade and energy exchanges continue to grow annually. Despite tensions, leaders maintain open communication channels, ensuring flexibility.

“Not Allies, but Better Than Allies”: De Facto Alignment vs. Formal Treaty

Both capitals eschew a NATO-style treaty, instead calling their partnership “not allies, but better than allies.” Vladimir Putin has termed it a de facto alliance, a label that gained prominence post-2022. This terminology allows for flexibility on sovereignty while signaling a lasting partnership under external pressures.

Beijing has not recognized Russia’s annexation of Crimea, and Moscow does not endorse China’s expansive South China Sea claims. Yet, their strategic cooperation endures through energy deals, parallel views on a multipolar world, and coordinated voting in international forums.

Putin–Xi Jinping Meetings and Summit Diplomacy

Putin Xi Jinping meetings have been instrumental in shaping this alliance. Their meeting in Beijing on February 4, 2022, came as Russian forces gathered near Ukraine. They have maintained regular communication, including a notable visit to Moscow for Victory Day celebrations. These frequent meetings ensure policy alignment across various ministries.

During the COVID-19 pandemic, disagreements over Chinese restrictions on Russian seafood and strict border controls emerged. Despite these, the alliance continued to engage at the highest levels, managing disputes and keeping economic channels open. These channels were vital for logistics and financial support.

Strategic Cooperation Between Russia China Across Security, Energy, and Diplomacy

Strategic cooperation between Russia and China spans energy sales, cross-border payments, and diplomatic coordination. Russia has redirected its exports to Asian markets, with China securing discounted hydrocarbons and stable supply lines. Joint statements emphasize state sovereignty and non-interference while promoting a multipolar system.

Security coordination, though not mutual defense, includes regular military consultations and patrols in adjacent seas. Diplomatically, both sides align their messaging at the United Nations and within regional bodies. This reinforces a de facto alliance without the need for legal commitments.

Russia China Military Collaboration and Security Architecture

Defense ties are now central to Moscow–Beijing relations. China has been acquiring advanced aircraft, engines, and air defense systems from Russia. This has been through arms sales and licensing agreements. These transactions, along with joint military exercises, have significantly contributed to the PLA’s modernization efforts. Both sides maintain political deniability through these arrangements.

Regular naval and air exercises have become a visible aspect of their shared security architecture. These include patrols in the Sea of Japan and the East China Sea. Coordination is facilitated through ministerial dialogues, service-to-service exchanges, and staff talks. These efforts are supported by frameworks tied to the Shanghai Cooperation Organisation.

Following Western sanctions in 2014 and further measures in 2022, Russia has increased its reliance on the Chinese market. This has broadened the scope of military collaboration between the two nations. Beijing has maintained a cautious approach, avoiding direct actions that could trigger secondary penalties. Yet, it has allowed trade and technology exchanges that enhance practical cooperation.

Both sides employ synchronized messaging and selective transparency to signal deterrence without a mutual defense pact. Mechanisms for consultation, deconfliction, and crisis communication have evolved. These structures provide operational frameworks while avoiding treaty obligations. This approach supports PLA modernization and facilitates learning across various military domains.

Arms sales serve as a gauge of trust between the two nations. Transactions include Su-family fighters and S-400 systems, alongside joint research in electronics and space-based services. The pattern of exercises, port calls, and patrol planning reflects steady Moscow–Beijing relations. These efforts aim to shape regional balances through presence and routine, without formal alliance commitments.

| Domain | Modality | Example | Strategic effect |

|---|---|---|---|

| Leadership | Summit diplomacy & calls | Beijing (Feb 2022); Moscow (May 2025) | Signals continuity & crisis management |

| Energy | Long-term contracts; redirected exports | ESPO + discounts | Revenue stability (RU); diversified supply (CN) |

| Finance | National-currency use | More ruble–yuan settlement | Less exposure to Western controls |

| Diplomacy | Multilateral coordination | UN votes & joint statements | Influence without treaty |

| Security | Staff talks; joint patrols | Regular air/naval activities | Interoperability sans alliance |

Regional Institutions and Economic Blocs

Regional bodies play a key role in how Moscow and Beijing coordinate policy. They provide a framework for neighbors to engage without taking sides. This framework supports a multipolar world order by shaping trade, security, and finance.

Shanghai Cooperation Organisation’s Role in Central Asia

The Shanghai Cooperation Organisation was founded in 2001 by China, Russia, and several Central Asian countries. It focuses on security talks in the region. The Regional Anti-Terrorist Structure supports counterterrorism efforts, border security, and information sharing.

The SCO has also been a venue to manage rivalry. During the 2008 war in Georgia, Beijing emphasized sovereignty and kept the bloc neutral. This limited spillover. India, Pakistan, and Iran bring wider stakes, but the core agenda remains stability and trade corridors linking Central Asia to China and Russia.

Eurasian Economic Union Linkages to Belt and Road Corridors

Customs and logistics plans now tie the Eurasian Economic Union to Belt and Road corridors across the steppe. Russia, Kazakhstan, Belarus, Armenia, and Kyrgyzstan coordinate tariffs and standards. This eases rail and road flows to Chinese hubs such as Xi’an and Chongqing.

These linkages reduce exposure to maritime chokepoints and dollar-centric routes. Joint work on dry ports, fiber links, and energy grids aims to speed freight while cutting costs. Policy banks like the Asian Infrastructure Investment Bank and the New Development Bank finance projects that complement this network.

Multipolar World Order Narratives and Third-Country Balancing

By pairing these institutions, Beijing and Moscow promote a multipolar world order. This offers more strategic options. The pitch is practical: more routes, more lenders, and more policy venues.

For third-country balancing, the menu is expanding. India uses the SCO for security dialogue while courting U.S. technology ties. Turkey engages energy talks with Russia and Central Asia, yet remains in NATO. Gulf states and ASEAN economies test overland freight and new financing without breaking from Western markets.

- Energy: Russia’s role in OPEC+ aligns with demand signals that affect rail and pipeline planning.

- Finance: Multilateral banks broaden funding beyond Western syndicates.

- Connectivity: Overland Belt and Road corridors link to EAEU rules that streamline transit.

Together, the Shanghai Cooperation Organisation and the Eurasian Economic Union offer tools for third-country balancing. They reinforce the case for diversified trade lanes within a multipolar world order.

Stress Points, Divergences, and Western Responses

The partnership advances, yet key rifts remain visible to policymakers and markets. Western responses track these gaps while weighing costs and risks. NATO planning, U.S. policy debates, and European deliberations all factor in energy security, sanctions, and logistics pressure points.

Trade data and border controls show where friction can spike. So do shipping lanes, maritime insurance access, and pipeline routes that link Russian supplies to Asian demand.

Crimea Recognition, South China Sea Claims, and Pandemic Frictions

Beijing has not recognized Russia’s annexation of Crimea, and Moscow does not endorse China’s South China Sea claims. These positions create diplomatic space that both sides manage but do not erase.

During the pandemic, China curtailed Russian seafood imports over contamination claims and tightened trucking at border crossings. Drivers staged protests as queues lengthened, adding costs and delays to overland trade. The episode exposed a logistical weak spot that informs risk planning.

NATO, U.S. Policy, and Leveraging Remaining Divergences

NATO assessments map where cooperation is firm and where it is thin. U.S. policy focuses on prioritizing threats, setting tradeoffs, and sequencing tools that raise the price of coordination between Moscow and Beijing.

American leadership remains central for rallying European resources. Targeted Western responses include export controls on dual-use items, tighter scrutiny of financial channels, and calibrated messaging to deter escalation while preserving room for diplomacy.

Energy Security, Sanctions, and Maritime Insurance/Pipeline Routes

Sanctions, price caps, and embargoes pushed Russia toward discounted sales, longer voyages, and alternative financing. Shifts in maritime insurance and the use of non-Western cover help keep cargoes moving, even as compliance checks increase.

Pipeline routes such as ESPO and expanded tanker fleets sustain flows to Asia. OPEC+ decisions that include Russia ripple through global prices and domestic inflation, shaping U.S. policy on the Strategic Petroleum Reserve and broader energy security planning.

Western responses now monitor technology transfers, logistics networks, and rerouted payments to curb evasion without forcing third countries into tighter alignment with the partnership.

Conclusion

The sino-russian partnership has evolved from post–Soviet normalization to a de facto bloc driven by mutual interests. Treaty commitments, border settlements, and regular summit diplomacy are the pillars of this alliance. Economic ties are now centered on hydrocarbons, pipelines, and record trade volumes. Joint military drills and coordinated diplomacy extend their influence across Eurasia.

The term “russia china alliance” remains informal, yet their strategic cooperation is consistent and tested by sanctions and Western rivalry. Pragmatism continues to define Moscow–Beijing relations, despite divergences on sovereignty claims, defense exports, and crisis management. Energy prices, OPEC+ dynamics, and state-owned enterprise behavior influence their leverage. Technology controls, maritime insurance, and logistics constraints also pose challenges.

Western policymakers face the challenge of identifying where interests align and diverge. They must target policy responses based on these findings. Aligning export controls with energy market realities, strengthening regional institutions, and coordinating with allies can increase the cost of opportunistic trading. This approach keeps channels open for de-escalation, making coherent, evidence-based policy more effective than broad rhetoric.

The path forward indicates sustained strategic cooperation in a contested multipolar world. As pipelines expand, prices fluctuate, and sanctions change, the russia china alliance will continue to shape outcomes from Central Asia to the Arctic. Moscow–Beijing relations, built on durable incentives, are poised to endure. Each capital will maintain its flexibility, even as they cooperate.

FAQs

What Defines The Russia China Alliance Today?

The partnership is centered on energy, trade, and diplomacy. Leaders in Moscow and Beijing describe it as “not allies, but better than allies.” Vladimir Putin has called it a de facto alliance. There is no mutual defense treaty, but routine coordination shapes policy across Eurasia and in multilateral forums.

How Did The Sino-Russian Partnership Evolve After 1991?

After the Soviet collapse, Boris Yeltsin’s 1992 trip to Beijing opened a reset with Jiang Zemin and Yang Shangkun. A 1996 joint communique pledged an “equal and reliable partnership,” and border demarcation progressed, ending decades of disputes and normalizing Moscow–Beijing relations.

What Is The Significance Of The 2001 Treaty Of Good-Neighborliness And Its 2021 Renewal?

The treaty formalized cooperation across strategic, economic, and political areas. It carried implicit security dimensions. Renewed in June 2021 for five years, it underpins long-term coordination without codifying a NATO-style defense pact.

How Large Is Russia–China Trade And What Changed In 2022?

Bilateral commerce reached about 0 billion in 2023. Western sanctions pushed Russia to redirect energy and commodities to Asia. China absorbed more oil, coal, and goods, helping Russia keep trade flowing.

What Role Do Energy Flows And The ESPO Pipeline Play?

The Eastern Siberia–Pacific Ocean pipeline anchors long-term crude deliveries to China. As Europe curbed Russian coal and oil, flows shifted to Asia. Discounted barrels and alternative shipping routes sustained volumes despite restrictions.

How Do State-Owned Enterprises And OPEC+ Affect Prices?

State-owned firms control most global reserves and output, shaping investment and supply. OPEC+, which includes Russia, has cut production at times, lifting prices above per barrel. These moves affect both partners’ export revenues and policy choices.

What Is The SCO’s Role In Central Asia?

The Shanghai Cooperation Organisation provides a platform for counterterrorism, border security, and regional coordination. It helps manage China–Russia competition while signaling non-Western security cooperation. During the 2008 Russo-Georgian war, the SCO stayed neutral, reflecting sovereignty principles.

Where Are The Main Fault Lines In The Partnership?

Beijing has not recognized Russia’s annexation of Crimea, and Moscow does not back expansive Chinese claims in the South China Sea. Pandemic-era disputes over seafood imports and cross-border trucking also exposed frictions, though high-level channels managed tensions.

Is The Russia China Alliance Likely To Become A Formal Defense Pact?

Both sides avoid a NATO-style treaty to maintain flexibility and limit escalation risks. The current model—de facto alignment with expanding trade, energy, and security coordination—delivers benefits without binding commitments.